Life is a precious gift that should be cherished, yet it is a fragile thing that can be easily shattered. Unexpected events such as accidents, illnesses, natural disasters, and other unforeseen circumstances can have devastating consequences for individuals and their families, wiping out savings, causing financial ruin, and jeopardizing future plans. Despite the greatest care, the forces that threaten lives and everything around it remain as potent as ever.

A single moment of carelessness or a twist of fate can change everything in an instant. Hence, it becomes all the more important to appreciate the preciousness of everything around us and do everything we can to protect it, not only for ourselves, but for everyone around us.

What is insurance?

Insurance is an essential part of future planning, providing a crucial safety net that helps to protect individuals and families against unforeseen events that could otherwise derail their plans and aspirations. Insurance helps to mitigate any risk to families by providing a measure of financial protection and stability. By having insurance coverage, individuals and families can plan for the future with greater confidence, knowing that they are protected against the unexpected. Insurance can help to ensure that major life events, such as the birth of a child, the purchase of a home, or retirement, can be achieved with financial security and stability.

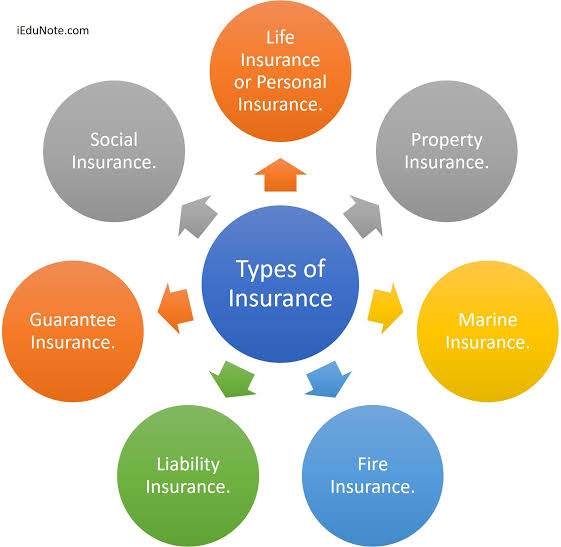

Types of Insurance:

There are various types of insurance, each designed to against specific risks and any uncertainties.

The most common types of insurance include life insurance, health insurance, auto insurance, homeowner or rental insurance and disability insurance. Some other insurances also provide coverage for certain other uncertainties like travel insurance, pet insurance and even wedding insurance.

- Life Insurance provides a payout to a designated beneficiary upon the death of the policyholder. It can help to provide financial security for loved ones in the event of a tragedy.

- Health insurance is designed to cover the costs of medical care and treatment. It can include coverage for routine checkups, hospital stays, and prescription medications.

- Auto insurance is a type of insurance that covers the costs associated with car accidents, including damage to vehicles and injuries sustained by drivers and passengers.

- Homeowners insurance protects homeowners against damage or loss to their property, including damage caused by fire, theft, or natural disasters.

- Disability insurance provides financial protection for individuals who become disabled and are unable to work. It can help to cover lost income and other expenses associated with the disability.

- Liability insurance protects individuals and businesses against legal claims and lawsuits. It can cover the costs associated with legal defense and any damages awarded in a lawsuit.

The Purpose And Working Of Insurance:

As you have already read, insurance is an important tool for future protection and planning. The fundamental of insurance is to protect and mitigate any uncertainty in the lives of individuals, families and businesses.

By paying a relatively small premium, policyholders can transfer the financial risk of a potential loss to an insurance company, which assumes responsibility for paying out compensation in the event of a covered loss. In this way, insurance offers a form of financial protection that can help to minimize the impact of unexpected events and provide individuals and businesses with greater financial security and stability.

Another major purpose of insurance companies is to promote risk management and help people manage risks more effectively. Insurance companies have extensive experience and expertise in assessing risks, and they can work with policyholders to help them identify potential risks and develop strategies to mitigate them.

In this way, insurance can be a valuable tool for promoting better risk management and helping individuals and businesses to reduce their exposure to potential losses.

Another important purpose of insurance is to promote economic stability and growth. By providing a financial safety net that protects individuals and businesses against unexpected losses, insurance can help to stabilize the economy and promote greater confidence and security.

This, in turn, can encourage investment and growth, as individuals and businesses are more likely to take risks and pursue opportunities when they feel that they are protected against potential losses.

Ultimately, the purpose of insurance is to provide individuals and businesses with greater peace of mind, enabling them to pursue their goals and aspirations with confidence and security.

Conclusion

In summary, insurance is not just a boring necessity but a powerful tool that can bring peace of mind and financial security to those who use it wisely.

From protecting a small business from a devastating lawsuit to helping a family recover from a natural disaster or a tragedy, insurance provides a vital safety net in a world that is full of uncertainties.

Moreover, it is fascinating to see how insurance has evolved over time to meet the changing needs of society and how it continues to adapt to new challenges, such as cybersecurity threats. As we navigate the complexities of modern life, insurance remains a valuable asset that can help us mitigate risk and enjoy greater confidence in our future.